James McGrath from MYOB discusses the increase in alternative lenders in the modern market, and the potential benefits of this for small business. ~ WizeOwl.

–

There are now more sources of funding for small businesses than in any other time in history.

The rise and rise of financial tech (fintech) plays around the world has been astonishing to witness over the past few years, with alternative lenders able to effectively act as a competitor to large banks in the business finance market.

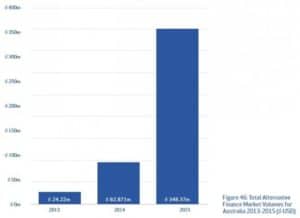

According to a comprehensive report from KPMG done earlier this year, the online alternative finance market in Australia reached just over $348 million in 2015 – rising from a shade under $83 million just two years prior.

That’s an annual growth rate of 281 percent.

From Harnessing potential: The Asia Pacific alternative finance benchmarking report — KPMG

The Australian market has grown to be the second largest in the Asia Pacific region, only ousted by the behemoth that is China.

The KPMG report noted that Australian online lenders could obtain models and underwriting from overseas-based players, meaning institutional funders were much more likely to come on board.

That means the sector could scale up in a rapidly short amount of time.

The upshot? For an ambitious SME, funding is available from an increasing number of sources.

Increasingly, smaller businesses are finding the hands-on approach of alternative lenders an attractive proposition.

“Online alternative finance is a perfect symbol of the transformation of the global economy by digital means,” said the Dean of the UNSW’s Business School, Professor Greg Whitwell, as part of the report.

These are huge, economy-shaking trends.

Once upon a time a small business needed to make an appointment with their local banker, bring in reams of financial statements and hope for the best.

Now fintech companies are able to understand the strengths, weaknesses and opportunities of a small business through algorithms and the canny application of historical data.

No longer are large financial institutions the only game in town – and in fact many large players are teaming up with disruptive fintech plays to bring new solutions to market.

General Partner of NAB Ventures, Melissa Widner previously told The Pulse that the bank was investing in innovative plays which could harness the scale of the bank’s distribution channels.

Far from being threatened by the rise of fintech players, Widner said, the bank wanted to work with them to bring customers better products.

While this may seem theoretical for now, the megatrends are having a very real and positive impact on Australia’s SMEs.

A good hair day

Sydney-based Elyston Hayden is one person who can personally attest to the power of alternate finance providers.

After discussion with his accountant, he took out an OnDeck loan to relocate his hair salon from the Sydney CBD.

“I was a little bit skeptical because I had never taken out a loan before, and it was something I didn’t really understand,” said Hayden.

Together, Hayden and his accountant lodged an online application and within two business days he was approved with funds in hand.

With the additional funding, Hayden could relocate his business and avoid the gargantuan rents of the CBD.

“The rent was eating up my cashflow, which meant I had to do a lot more cuts and colours than I needed to and it was wearing me down,” said Hayden.

“I want to hire more staff and expand the business, which is something I can do now that I don’t have to pay such high city rent.”

He said he had considered a bank overdraft, but had found dealing with a fintech player such as OnDeck less of a hassle.

“It was a fast-approved loan – which was good, and hassle free,” said Hayden.

“It was definitely easier than dealing with the bank. [OnDeck] can focus on the client a little bit more – the client experience is a lot better.”