What is Cloud-based Payroll Software?

Payroll management can be a daunting task for many businesses. Payroll software could be the answer, cloud-based payroll software is able to streamline and automate many time consuming and previously manual systems. Creating greater efficiency, less stress and happier employees.

Using the cloud simply means using the internet to store data and run applications. It's more secure and convenient, with the added benefit that all the IT work is done for you. You don't have to worry about backups, storage space or software upgrades.

But do you need payroll software and which one is the best option for your business?

Your Business Needs New Payroll Software If ...

- Your administration team struggles to keep up to date with payroll record keeping.

- ATO Commitments & Single Touch payroll is a headache.

- There are complex salary and wage rules for your business.

- Your team management/payroll software is not compatible with your accounting system.

- Your management of Super and PAYG is not meeting statuary contributions requirements.

- Still, using paper-based time & leave tracking.

- Payroll processing takes to long and is often late.

- You have to many staff to remember how much leave time they have left for the year.

If you struggle with any of the above, you should be looking at a new payroll software solution.

As bookkeepers, we work with a lot of different business accounting software. Below are some payroll solution options with a focus on Xero Accounting software.

If you have any questions about these payroll options please get in touch or comment below.

Payroll Software Options

There are multiple options available. We are going to look at 3 of the most popular in Western Australia.

What is Xero Payroll?

Payroll is more than just payments to staff, a list of people you employ and what they are paid. It’s also about the tax information and complying with legal requirements, such as Single Touch Payroll.

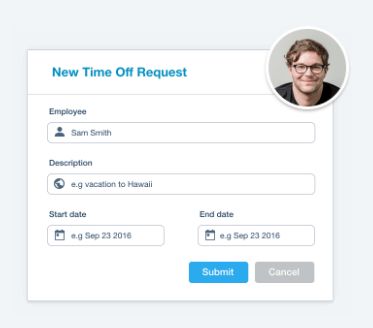

Xero Payroll simplifies and automates your payroll and provides access for your employees to view their payslips, request time off, submit timesheets, and update their contact details.

Xero Payroll Inclusions & Exclusions

Xero pricing for Payroll Software

What is Deputy?

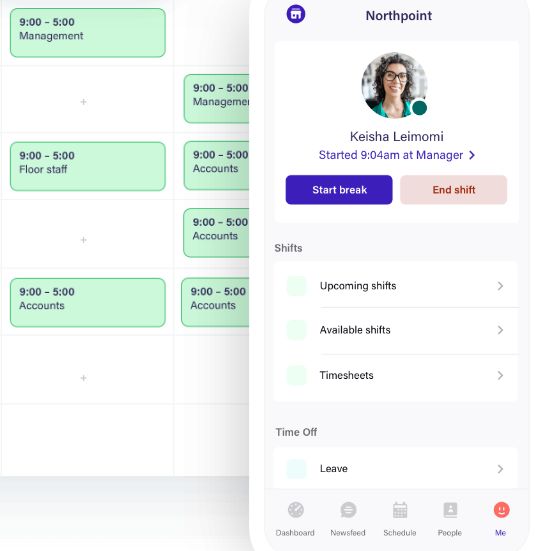

Deputy is a simple and innovative workplace management solution for employee scheduling, time and attendance, team communication, task list, payroll information and more.

From scheduling employees and tracking time to processing their wages and leave requests, Deputy and Xero integrate seamlessly to help your business run beautifully.

Xero Payroll & Deputy - Inclusions & Exclusions

Onboarding & Scheduling

Automated overtime / penalty calculations

Complete real time and location tracking of staff

Excellent connection to the ATO

Direct link for Superannuation payments

In built payroll

Creates ABA files for upload to bank

Deputy is not a complete payroll system, must have Xero payroll as well

Does not allocate employee pay rate by award standard, this is manual

Maximum of 200 employees

Xero & Deputy pricing for Payroll Software

Deputy Premium Scheduling, Time & Attendance, with Reporting, is billed monthly per user.

Deputy is not a stand-alone solution you will also need a Xero subscription.

For a small business with more than 2 employees, you will need to purchase the Xero Premium package. Xero offers a Premium package for 5, 10, 20, 50, 100 depending on the number of employees you have.

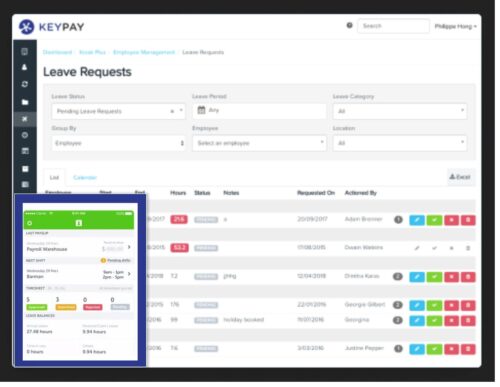

What is Keypay?

KeyPay is a fully automated payroll solution, providing time-saving for businesses of all sizes. With super calculations, ATO reporting, automated payroll calculations, employee self-service login, rostering, time and attendance, paperless employee onboarding.

KeyPay changes the way businesses work and pay.

KeyPay - Inclusions & Exclusions

Onboarding & Scheduling

Automated overtime / penalty calculations

Complete real time and location tracking of staff

Automated overtime / penalty calculations

Excellent connection to the ATO

Direct link for Superannuation payments

In built payroll

Creates ABA files for upload to bank

Keypay is a complete Payroll system

Creates ABA files for upload to bank

KeyPay Features

KeyPay with Xero pricing for Payroll Software

KeyPay has 2 options Standard and Plus, both are for unlimited users and are billed monthly per user.

KeyPay is a stand-alone solution for payroll, you will however still need accounting software for your general bookkeeping.

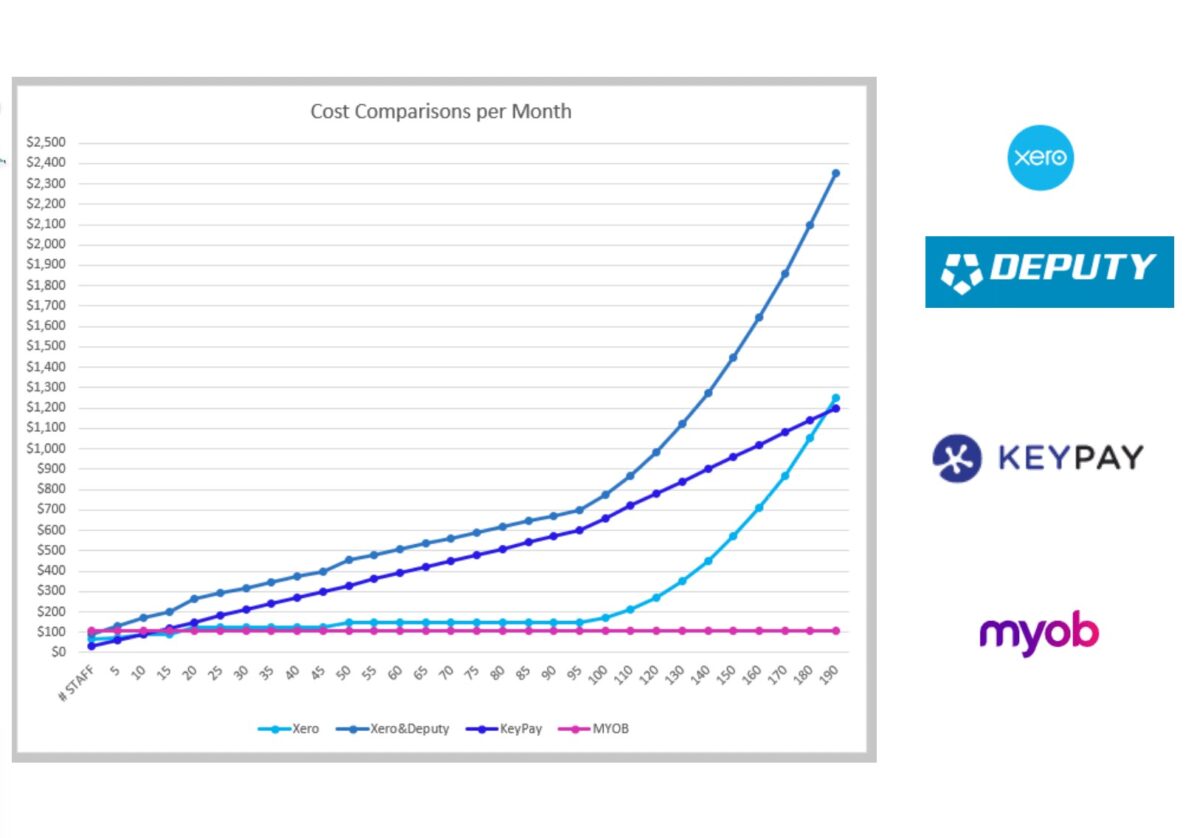

Your Xero plan does not need to increase as the number of your employees' increases making it a cheaper option than Deputy & Xero, see the graph below

Cost comparison for software payroll accounting packages and apps.

Free Coffee & Chat

Contact us today for a free chat about your payroll software requirements