We all know compliance is a major factor in running any business,

but what is Compliance exactly?

1. Assess the risks

Depending on your business type, the size and industry you are working in, there can be a variety of different risks.

It’s important to perform risk assessments regularly to identify these threats and put preventative measures in place.

2. Perform audits

It’s important to review your internal systems regularly and audit your own processes to identify and fix any non-compliance areas before a government auditor comes knocking.

It’s also a good skill to be able to identify your own flaws and work out how best to overcome these.

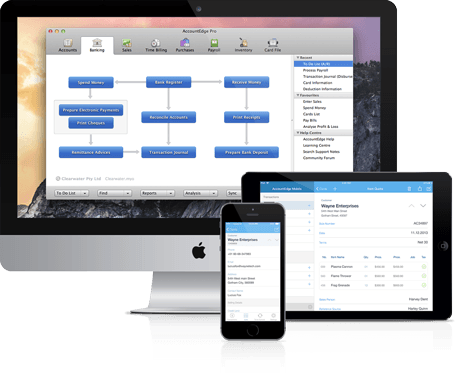

3. Use the right software

Use trusted and reliable software, only!

Do your homework, ask around, contact your local bookkeepers and ask for advice. There are more important considerations than price, and rarely is the cheapest option the most reliable.

Our recommendations include Xero, MYOB, Quickbooks, and Office 365

4. Protect your files

Cyber security continues to be a global threat but it is not difficult for you to prevent. Protecting yours and your clients personal information is crucial, therefore we recommend imposing a suitable level of security to your data. Passwords are an obvious choice for added security, but you should consider how often passwords are to be changed, who has access to the passwords, 2 step authentication, etc.

Another strategy for data protection, is to limit who has access. You can set different levels of authorisation and decide who within your business should be able to view specific files.

5. Stay organised

It pays to be organised! Organising your documents can be done either electronically or physically. This not only helps you run a more efficient business but ticks boxes when you are audited. Being organised saves time during an audit, and in the every day running of your business.

There are also some legal requirements in place in relation to storing records, for example tax records are to be kept for a minimum of 5 years.

It is important to do your research and find out what requirements affect you.