Managing your business with Cloud Accounting!

Cloud Accounting is really the tip of a huge technologic ice-burg and it can be difficult to get things working without an expert on your side.

To give you an idea we are going to play pretend. Let’s say you are planning on opening your own coffee shop, we will call it "Quirky Coffee"! What cloud accounting services will you need to get your business running smoothly?

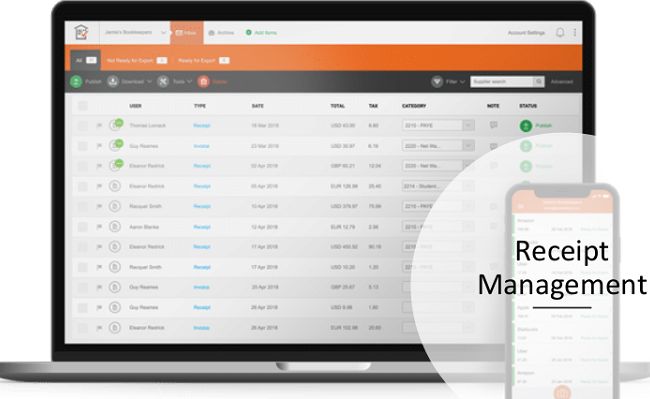

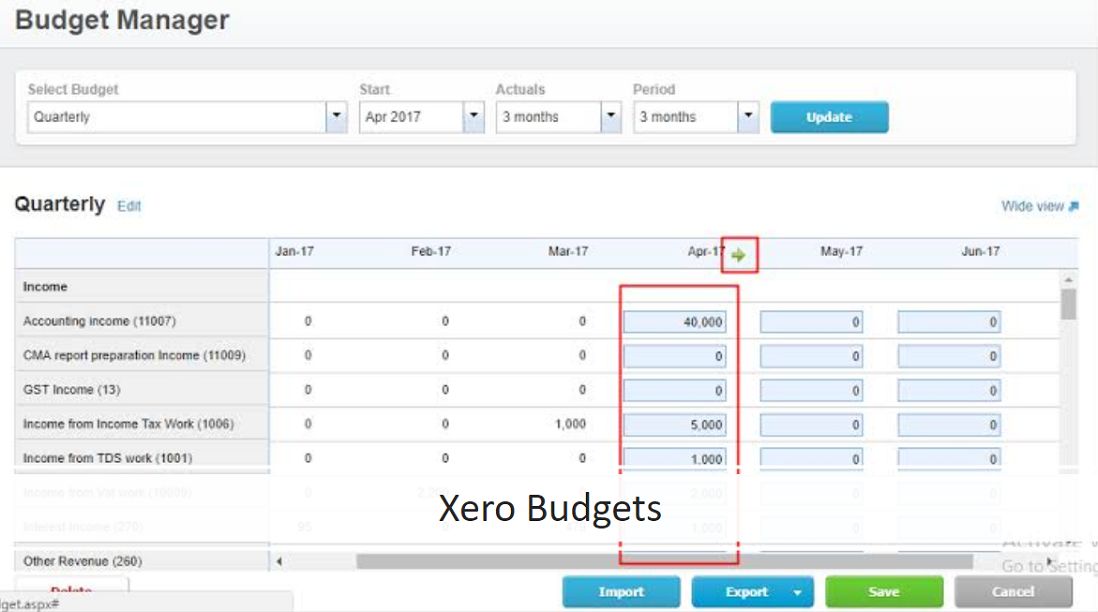

We are going to assume here, that you have already done some of the prep work like budgets, feasibilities and marketing plans. Now it is time to start buying your equipment. Buying stuff is easy, but you really need to record all those transaction. Having Accounting Software and Receipt Management Software in place to capture all the receipts, right from the start will get your business off to a successful start.

Managing the Receipts!

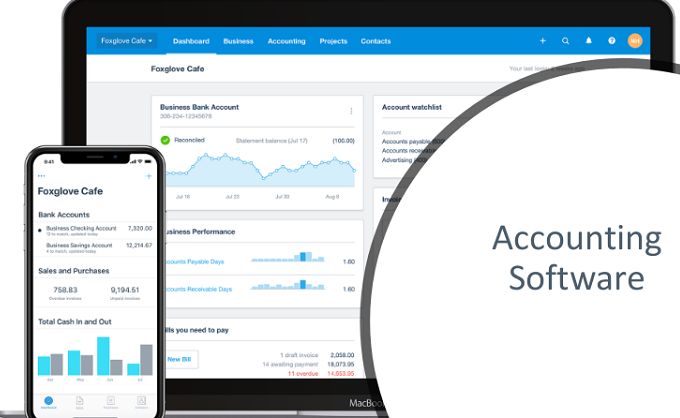

Managing the Numbers!

The next must have is your Accounting Package and Xero is a great option that we can setup for you.

Xero will be set up to capture GST, load transactions from your bank feeds and with an internal asset register to keep track of all those brand new sparkling coffee machines.

Also, can set up access to your Accountant, so the Accountant has access to your data to provide you with advice on all the decisions you might need to make in the future, like extra funding or opening other stores.

The best part of this setup is that Xero will be linked with Receipt Bank right at the start of your business, which means your books are going to be really organised.

Receipts are attached to transactions so if you have equipment failures receipts are on hand for refunds /returns / warranties.

GST and Tax Receipts are all added to transactions, so any financial advise you need can be organised and answers are at your finger tips AND all that data extractions that Receipt Bank is doing is feeding directly into Xero saving the business dollars in data entry and your time and stress worrying about lost receipts and tax information.

Bizwize will make sure all the links are working and all the bank rules are in place to make processing simple.

Managing the Team!

Now that your café is all kitted out, you are ready to open for business…..but are you?

Who is going to serve the coffees?

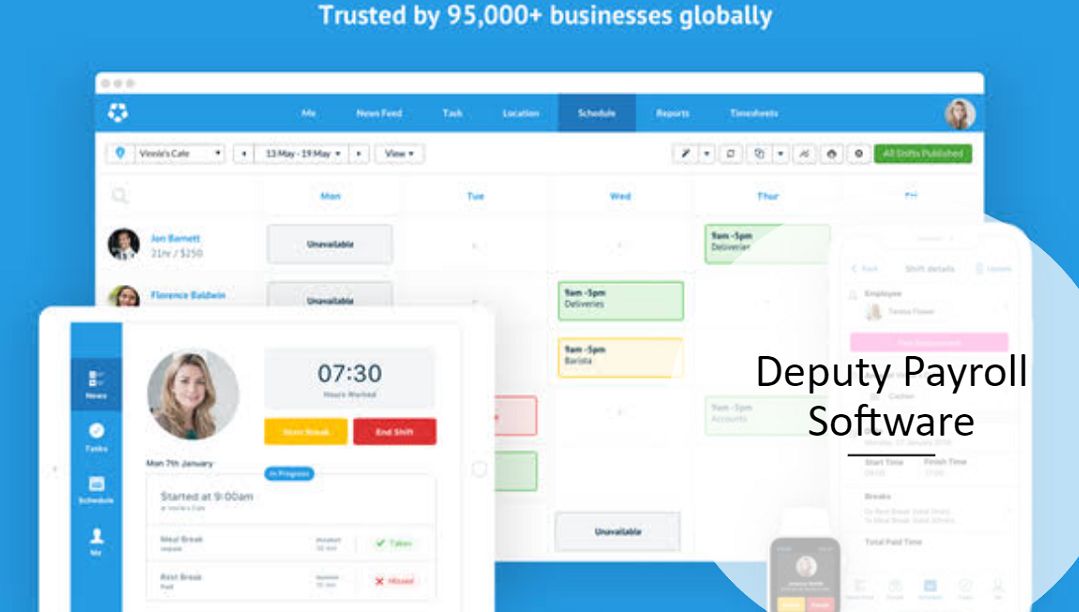

To manage your team we need to get some payroll software, we recommend one that includes the ability to setup and communicate shifts with your staff.

Deputy is a great piece of software that can help with staff management.

It contains awards (like the Fast Food Award) which you will need to know, information like when to pay overtime, meal breaks and also what to pay for seniors, juniors, full time, part time or casuals.

It also has an onboarding system, where you can send a link to new staff to fill in all the required details including tax file declarations and superannuation.

Once setup Staff are provided with the Deputy App on their phones, which then communicates with them when they have a shift and also allows them to tell you when they are available.

Managing the Cafe!

So you have your assets and your staff, but what about the coffee!!

What products are you going to serve, how much do you buy, what will it cost and how much will you sell it for???

Obviously what you sell will be entirely up to you, but you will need to be able to make decisions on what sells and what doesn’t, when to reorder and your staff need to know what they are charging.

Do you supply a $5 coffee, what size, it is extra for Soy? Can we pay by credit card?

You no longer need a cash register! Now there is an online system that integrates with Xero. Introducing Kounta. A Kiosk / Tablet system.

No need for a bulky register on your counter, just a hand held devise for table orders, tracking and monitoring of products sales, by day and time, so you can see trends for ordering. Additionally Kounta can flag when you are low on stock. With this system you can avoid having to say to customers “I am sorry we are out of Coffee”.

When linked to Xero you also have Cash Control, as you know how much should be getting banked. With integration to credit card processing, including CommBank.

Now everyone can come and have a coffee.

Managing the Software!

There is a lot of connections going on here. Receipt Bank, Xero, Deputy and Kounta.

As a café owner do you have the knowledge to get these setup and working? Do you have the time with all the hiring of staff, shop fit outs, inventory purchase and staff management? Or do you get an expert to help you?

Not only do the team at Bizwize know how to make this all work, we also know short-cuts to getting information into the systems.

Small business owners Don’t know what they Don’t know.

But we know lots about bookkeeping integrations and we can provide advice on what is best for your business when it comes to choosing the right accounting software for your business.

But beware! All these fabulous applications are being designed by teams of people who are all in business and therefore they all have a monthly fee.

When choosing your operational systems it is important to know when to spend and when not to spend.

If Receipt Bank costs $55 per month Xero costs $100 per month; Deputy costs $40 per month; Kounta costs $100 per month. That is $295 per month for software….that is a lot!

Or is it?

Lets take a look what your expenses could be without the software in place and setup correctly, and then you can really understand what you are savings by installing the correct accounting software.

- Receipt Bank – can’t find a receipt and can’t claim $$$$$

- Xero – extra cost at the Accountant to get your tax down, fines from the ATO $$$$$$$

- Deputy – staff not turning up for shifts, staff saying they worked when they didn’t – Look at poor old George Colinbarus!

- Kounta – not having stock, not making the sales, not charging enough $$$$$$$$

- And then we haven't even stopped to look at what these applications save you in your time. Time that you can be better spending working on growing your business.

We have helped a lot of clients get their software working in a way that makes them more productive and saves them heaps in time and money.

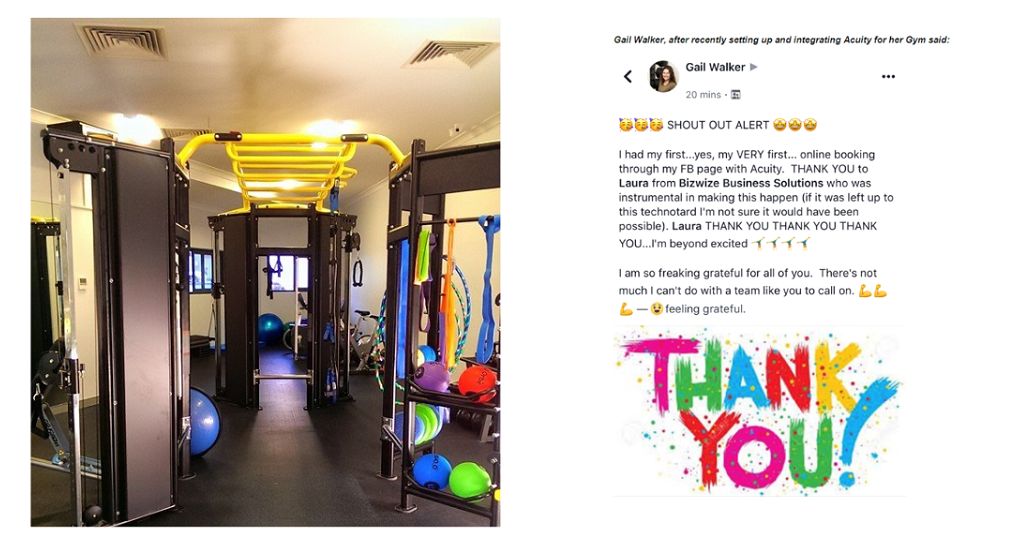

We have a number of testimonials on our website. One really simple one that resulted in immediate results was . . . Gail from Power House Training studio, a real simple setup linked Xero, acuity and stripe with immediate success as she had her first fully paid appointment within an hour of going live and she was thrilled!